All Categories

Featured

Table of Contents

The is a Module from Instead of the complete 8-week program, overages and get added papers regarding excess excess. This course is made for both new and seasoned, Genuine Estate Entrepreneurs that wish to find out just how to produce a profitable realty business by leveraging the covert rubies offered throughout the USA with Tax Obligation Liens & Tax Obligation Act Public Auctions.

This training course includes a detailed process of how to end up being a Surplus Overages Healing Representative (surplus funds excess proceeds). The program consists of sustaining records, lists, sources and state legislations to aid browse to the states that are financier friendly. The Tax Deed Brilliant Surplus Recovery Representative course is promptly offered upon effective enrollment

For added benefit, signed up pupils can access the training course lessons 24/7 whenever it's hassle-free for them. The Tax Obligation Deed Surplus Overages Healing program is composed of 15 lessons.

The is a Component from the Instead of the full 8-week program, overages and get extra papers regarding surplus excess. This program is designed for both new and experienced, Property Business owners that want to discover just how to develop a lucrative realty service by leveraging the surprise diamonds offered across the USA via Tax Obligation Liens & Tax Obligation Action Auctions.

This program is for new or skilled investor that what to learn the ins and outs of being a Surplus Healing Agent. Tax Obligation Deed Surplus Recuperation Agents help previous residential or commercial property owners that shed their properties in a Tax obligation Deed Sale, send insurance claims to collect cash owed to them from the area.

Foreclosure Tax

The training course consists of supporting documents, lists, resources and state legislations to assist navigate to the states that are capitalist pleasant. The Tax Obligation Deed Genius Surplus Recovery Representative training course is right away offered upon effective enrollment.

The Tax Deed Surplus Excess Recuperation course is composed of 15 lessons. Most pupils complete the course in 1-2 weeks depending on their duration.

Tax sale excess occur when a tax-foreclosed residential property is marketed at auction for a higher price than the owed taxes. The surplus funds, also called excess, are the difference in between the list price and the taxes due. This excess is typically returned to the initial house owner. If unclaimed, you, as a capitalist, can assist find and declare these excess funds for the former homeowner for a cost.

This company entails helping people on declaring cases. There are tax act excess, mortgage foreclosures that bring about surplus funds and likewise unclaimed state funds.

Every now and after that, I listen to discuss a "secret brand-new chance" in the business of (a.k.a, "excess profits," "overbids," "tax sale excess," and so on). If you're totally strange with this concept, I would love to provide you a quick overview of what's going on right here. When a homeowner stops paying their real estate tax, the regional community (i.e., the county) will certainly wait for a time before they confiscate the building in foreclosure and market it at their yearly tax obligation sale public auction.

utilizes a comparable model to redeem its lost tax revenue by selling buildings (either tax acts or tax liens) at a yearly tax obligation sale. The details in this article can be impacted by lots of special variables (taxsalelists). Always speak with a competent attorney prior to acting. Intend you own a home worth $100,000.

Tax Lien Property Listing

At the time of repossession, you owe about to the county. A couple of months later on, the area brings this building to their yearly tax obligation sale. Here, they offer your property (along with lots of various other delinquent homes) to the greatest bidderall to redeem their shed tax obligation income on each parcel.

Many of the investors bidding on your home are totally conscious of this, as well. In lots of cases, residential properties like yours will certainly obtain bids Much beyond the amount of back tax obligations really owed.

Tax Foreclosure Property Sales

Get this: the county only needed $18,000 out of this residential or commercial property. The margin in between the $18,000 they required and the $40,000 they obtained is referred to as "excess profits" (i.e., "tax sales overage," "overbid," "surplus," and so on). Lots of states have laws that restrict the area from maintaining the excess settlement for these residential properties.

The region has policies in location where these excess earnings can be claimed by their rightful proprietor, typically for a marked period (which varies from state to state). If you shed your residential or commercial property to tax foreclosure because you owed taxesand if that residential or commercial property subsequently offered at the tax sale auction for over this amountyou can probably go and gather the difference.

Unclaimed Tax Overages

This includes showing you were the prior proprietor, finishing some documents, and waiting for the funds to be provided. For the average individual that paid full market worth for their residential or commercial property, this approach does not make much sense. If you have a major amount of money spent right into a home, there's means also a lot on the line to simply "allow it go" on the off-chance that you can bleed some additional money out of it.

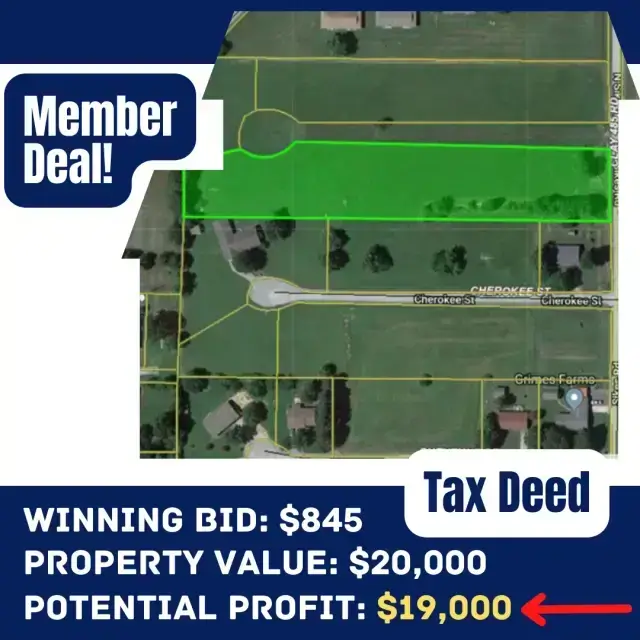

With the investing strategy I use, I can buy homes free and clear for dimes on the dollar. When you can buy a building for an extremely inexpensive rate AND you understand it's worth significantly more than you paid for it, it might extremely well make feeling for you to "roll the dice" and attempt to accumulate the excess earnings that the tax obligation repossession and public auction process generate. tax delinquent sales.

While it can absolutely pan out similar to the means I've explained it above, there are likewise a few disadvantages to the excess earnings approach you really ought to recognize. While it depends greatly on the characteristics of the residential or commercial property, it is (and sometimes, most likely) that there will certainly be no excess earnings generated at the tax sale public auction.

Foreclosure Refunds

Or probably the area does not produce much public interest in their auctions. Either way, if you're buying a property with the of letting it go to tax repossession so you can collect your excess profits, what if that cash never comes with?

The very first time I sought this strategy in my home state, I was told that I didn't have the alternative of asserting the surplus funds that were generated from the sale of my propertybecause my state didn't enable it. In states such as this, when they produce a tax obligation sale overage at a public auction, They just maintain it! If you're thinking of using this method in your organization, you'll desire to think long and tough regarding where you're doing service and whether their regulations and statutes will certainly also enable you to do it.

I did my finest to provide the correct solution for each state above, but I 'd recommend that you before waging the assumption that I'm 100% appropriate (free tax lien information). Bear in mind, I am not a lawyer or a CPA and I am not trying to offer specialist lawful or tax advice. Speak with your attorney or certified public accountant prior to you act on this info

The truth is, there are thousands of public auctions all around the nation each year. At numerous of these public auctions, hundreds (and even thousands) of investors will show up, enter a bidding war over a number of the homes, and drive prices WAY more than they must be. This is partially why I have actually never been a massive follower of tax obligation sale public auctions.

Latest Posts

Delinquent Tax Search

Back Taxes Land For Sale

How Does A Tax Lien Foreclosure Work